How Overseas Property Investment Funds Luxury Real Estate Abroad?

How overseas property investment with international real estate funding and offshore wealth management help you learn how to buy property in Monaco?

The Hospitality Compass ~ dynamic pricing for hotels

Are you ready to discover how overseas property investment can transform your portfolio and secure access to the world’s most coveted addresses?

Many investors miss out on the seamless blend of international real estate funding and offshore wealth management that makes luxury real estate investment accessible—and you’re about to learn exactly how to buy property in Monaco without needless complexity.

In this guide, you’ll see the step‑by‑step approach to leveraging cross‑border financing, safeguarding your assets offshore, and pinpointing high‑yield opportunities in premier markets.

Keep reading to turn global property ambitions into a clear‑cut strategy that delivers lasting value.

Introduction

In today’s interconnected world, how overseas property investment unfolds as a powerful strategy to diversify portfolios and tap into premier real estate markets beyond domestic borders.

By blending international real estate funding with savvy offshore wealth management, investors gain access to luxury addresses—from Monaco’s sunlit promenades to Dubai’s skyline jewels—while optimizing tax efficiency and asset protection.

This section sets the stage by:

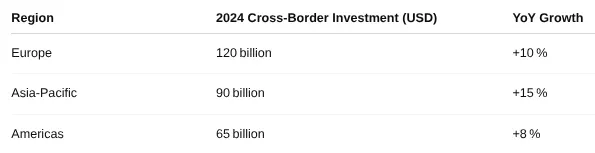

- Highlighting the rapid growth of cross‑border investments

- Underscoring why luxury real estate investment demands a tailored, data‑driven approach

- Previewing the step‑by‑step journey to how to buy property in Monaco without hidden pitfalls

Whether you’re a seasoned investor or new to global markets, this introduction frames the key concepts—overseas property investment, international real estate funding, and offshore wealth management—so you can immediately grasp why this guide will turn ambitious goals into measurable outcomes.

This data underscores the rising momentum of global property flows—proof that overseas property investment is no longer niche, but a mainstream path to premium returns.

What Is Overseas Property Investment?

Overseas property investment \—also known as how overseas property investment works—refers to the practice of acquiring real estate assets outside your home country to diversify your portfolio, access high‑growth markets, and tap into luxury segments that may offer stronger long‑term returns.

At its core, this strategy blends international real estate funding structures (like cross‑border mortgages, REITs, and private equity vehicles) with offshore wealth management solutions, allowing investors to spread risk across currencies, jurisdictions, and economic cycles.

When you engage in overseas property investment, you choose from several pathways:

These options harness luxury real estate investment opportunities by bundling capital from multiple investors, which in turn reduces individual exposure to a single property or local market shock.

Beyond the mechanics, the real allure lies in how overseas property investment dovetails with offshore wealth management. By establishing special purpose vehicles (SPVs) or trusts in low‑tax jurisdictions, investors not only shield assets from political or currency risk but also optimize tax liabilities and simplify estate planning.

In effect, you’re not just buying a physical address—you’re gaining a structured, compliant framework that enables you to buy property in Monaco (and other premier markets) with clarity, confidence, and scale.

Key Vehicles for International Real Estate Funding

When you explore how overseas property investment grows from concept to closing, understanding the funding vehicles at your disposal is crucial.

From traditional bank mortgages to sophisticated private‑equity structures, each option brings its own mix of flexibility, risk profile, and cost.

By comparing these key paths—bank financing, real estate investment trusts (REITs), and private equity or joint ventures—you’ll see exactly how international real estate funding can be tailored to your goals, whether you’re aiming for a turnkey acquisition in Monaco or diversifying with a high‑yield residential tower in Dubai.

Primary Funding Vehicles at a Glance

Each funding vehicle aligns differently with your need for offshore wealth management—for instance, REITs allow you to tap into global real estate pools without property‑level compliance, while private equity deals often require bespoke SPVs in low‑tax jurisdictions.

And when you’re aiming for luxury real estate investment, structuring a mortgage in Monaco or setting up a Cayman‑based SPV can mean smoother closings and enhanced asset protection.

By knowing which path matches your liquidity, risk tolerance, and geographic focus, you’re already one step closer to mastering how to buy property in Monaco and beyond.

Offshore Wealth Management Strategies

When you branch into luxury real estate through overseas property investment, pairing your purchase with a tailored offshore wealth management plan can unlock significant tax efficiencies, strengthen asset protection, and streamline succession planning.

Here’s how to approach it:

1. Select the Right Jurisdiction

Different financial centers cater to unique goals. Switzerland offers banking stability and strong privacy laws, Singapore delivers top‑tier regulatory oversight, while the Cayman Islands is famed for tax neutrality.

Matching your risk profile and investment size ensures your international real estate funding flows through the optimal channel.

2. Establish a Special Purpose Vehicle (SPV)

Forming an SPV—often a limited company or trust—shields your personal estate from liabilities and centralizes ownership of multiple properties.

This structure simplifies cross‑border financing, reduces stamp duties in many markets, and provides a clear vehicle for eventual resale or inheritance.

3. Partner with Local Experts

Offshore wealth management isn’t one‑size‑fits‑all. Engage fiduciary advisors, tax specialists, and on‑the‑ground legal teams in both your home country and the jurisdiction of your SPV.

Their insight into ongoing reporting requirements (e.g., CRS, FATCA) protects you from costly penalties and reputational risk.

4. Optimize for Tax Efficiency and Compliance

Through careful planning—such as leveraging double‑taxation treaties and utilizing tax‑neutral jurisdictions—you can retain a larger share of rental yields and capital gains.

At the same time, transparent compliance with anti‑money‑laundering (AML) and know‑your‑customer (KYC) standards preserves access to premier lending facilities for future luxury real estate investment.

5. Review and Adapt Regularly

Global regulatory landscapes shift. Annual health checks of your offshore structures ensure you continue to benefit from favorable tax treaties and remain aligned with evolving estate‑planning objectives.

This targeted approach to offshore wealth management ensures your international real estate funding seamlessly supports luxury real estate investment goals—whether you’re learning how to buy property in Monaco or exploring other high‑yield markets.

How to Buy Property in Monaco

Purchasing luxury real estate in Monaco may seem daunting, but by following a clear, step‑by‑step approach you’ll smoothly navigate local regulations, financing choices, and offshore wealth management considerations.

Here’s how overseas property investment—backed by international real estate funding and smart offshore structures—lets you acquire a prestigious Monaco address with confidence:

1. Assess Your Budget & Financing Strategy

- Estimate total costs: Monaco’s average price per square meter exceeds €45 000¹, so calculate purchase price plus 8–10 % in notary fees and taxes.

- Choose funding vehicle: Compare an international mortgage (often 60–70 % LTV) versus financing through a specialized real estate fund or private equity SPV.

- This leverages offshore wealth management to optimize tax and currency exposure.

2. Engage a Local Notary & Legal Advisor

- Monaco law mandates a notary (Notaire) to draft and register the deed of sale.

- Retaining a Monaco‑based legal expert ensures compliance with land registry requirements and KYC/AML checks.

3. Open a Monaco Bank Account

- You’ll need a local account to deposit your down payment and cover closing costs.

- Leading banks like HSBC Monaco and Crédit Foncier offer dedicated cross‑border mortgage packages that integrate international real estate funding with preferential rates.

4. Structure via an Offshore SPV (Optional but Powerful)

- Forming a Special Purpose Vehicle in jurisdictions like Luxembourg or the Cayman Islands can shield assets, simplify multi‑jurisdictional ownership, and support estate planning—in line with best practices in offshore wealth management.

5. Sign the “Compromis de Vente” & Secure Financing

- This preliminary purchase agreement locks in the price.

- At this point, your bank or fund will finalize lending terms.

- Ensure all funds are wired through your Monaco account to streamline the process.

6. Complete Closing (“Acte Authentique de Vente”)

- Within 30–45 days of the compromis, you’ll sign the final deed before the notary.

- Title transfers, funds clear, and you receive your official property certificate—congratulations on your luxury real estate investment!

7. Plan for Ongoing Management

- Whether you use a local property manager for rental income or hold as a capital‑growth asset, integrate periodic reviews through your international wealth manager to optimize ROI and stay compliant.

By breaking down each phase—from budget assessment through closing and beyond—you turn the question “how to buy property in Monaco” into a transparent, actionable process.

This fusion of overseas property investment, international real estate funding, and offshore wealth management empowers you to secure a world‑class address with minimal friction.

---

¹ Source: Monaco Real Estate Association, Q4 2024 Market Report.

Identifying High‑Yield Luxury Real Estate Markets

When you’re exploring how overseas property investment funds can unlock premier addresses, knowing where to focus makes all the difference.

Not every trophy asset delivers the same returns—some markets combine structural growth drivers, stable regulations, and currency advantages to deliver high‑yield luxury real estate investment opportunities that outpace global averages.

By weaving in international real estate funding and offshore wealth management strategies, you gain the flexibility to target those hotspots and optimize your portfolio’s risk‑adjusted returns.

Start by screening markets based on three pillars:

- Yield potential (gross rental yield and net operating income)

- Capital appreciation (historical price growth and future development pipelines)

- Regulatory stability (transparent legal frameworks, ease of capital flow, and tax treaties)

Below is a snapshot of five standout markets—each offering unique pathways for overseas property investment:

With this data in hand, you can leverage cross‑border financing to secure competitive loan‑to‑value ratios, tap into offshore wealth management structures to shield gains, and pinpoint the exact timing to enter each market.

Whether you’re refining your plan for how to buy property in Monaco or branching out into emerging luxury corridors, this targeted approach ensures your international real estate funding aligns with real‑world performance metrics—setting you up for enduring success.

Risk Management & Compliance

Protecting your capital and staying on the right side of the law are as vital to how overseas property investment works as securing financing or choosing a premier address.

By building robust risk‑management frameworks and compliance checks into every stage—from site selection to closing—you not only shield your wealth but also unlock smoother access to luxury real estate investment opportunities abroad.

When you’re exploring international real estate funding, consider these cornerstones:

1. Currency Risk Hedging

- Why it matters: Exchange‑rate swings can erode rental yields or push up your repayment on offshore mortgages.

- Tactics: Forward contracts or currency options to lock in favorable rates.

2. Legal & Regulatory Due Diligence

- Why it matters: Every jurisdiction—from Monaco’s tight notarial protocols to Singapore’s stamp duties—has unique filing, ownership‑structure, and reporting requirements.

- Tactics: Engage local counsel early; verify title searches, zoning compliance, and AML/KYC checks before committing funds.

3. Political & Market‑Volatility Assessment

- Why it matters: Changes in government policy, tax regimes, or macroeconomic shocks can alter market fundamentals overnight.

- Tactics: Monitor sovereign‑risk ratings; diversify across at least two markets to balance interest‑rate or policy shifts.

4. Operational & Exit‑Strategy Planning

- Why it matters: Maintenance costs, property management contracts, and resale constraints (e.g., Monaco’s pre‑emptive rights) directly impact liquidity and ROI.

- Tactics: Structure your offshore SPV with clear exit clauses; lock in property‑management fees in your base currency.

This framework ensures your overseas investments benefit from offshore wealth management safeguards and adhere to every compliance checkpoint—so you can focus on turning global property ambitions into lasting value.

Case Studies & Success Stories

Drawing on real‑world examples brings the principles of how overseas property investment and offshore wealth management into sharp relief—showing you exactly how to turn theory into high‑value outcomes.

Below are two concise stories of investors who leveraged international real estate funding to secure luxury real estate investment abroad, including a deep dive on how to buy property in Monaco without unnecessary hurdles.

In each case, you’ll see:

- Strategic Funding Vehicle: From cross‑border mortgages to private equity partnerships, discover which financing structure unlocked the deal.

- Offshore Structure: How a tailored SPV or trust optimized tax efficiency and asset protection.

- Outcome & ROI: Concrete performance metrics, so you can benchmark your own goals against proven success.

In the Cannes example, a UK family office pooled resources via an EU‑licensed JV, tapping international real estate funding to secure a premier villa at a discount to replacement cost.

By structuring ownership through a Luxembourg SPV and setting up a legacy trust in the Cayman Islands, they achieved both capital growth and estate‑planning efficiency.

Meanwhile, in Monaco—a market synonymous with exclusivity—the investor worked directly with HSBC Monaco to obtain a cross‑border mortgage, while channeling titleholding through an offshore trust.

This approach simplified how to buy property in Monaco by mitigating local lending restrictions and aligning with offshore wealth management best practices.

The result: a waterfront penthouse that delivered an 18 % return in just three years.

These stories illustrate the power of combining overseas property investment with targeted financing and legal structures, offering a transparent roadmap for your own luxury real estate investment abroad.

FAQ

In this FAQ section, you’ll find clear, concise answers to the questions most investors ask when exploring how overseas property investment can unlock luxury real estate investment opportunities—especially in coveted markets like Monaco.

By grouping the top queries around international real estate funding, offshore wealth management, and the step‑by‑step process of how to buy property in Monaco, we ensure you can get instant, voice‑search‑friendly insights without wading through dense text.

Each answer is crafted to cut straight to the point, so whether you’re weighing financing options, comparing jurisdictions, or clarifying legal steps, you’ll have actionable guidance at your fingertips.

What is the minimum investment for overseas property?

- Generally starts from USD 100,000 via REITs and USD 250,000 for direct purchases, depending on the market.

How do I set up an offshore structure for property investment?

- Partner with an international wealth manager to form an SPV in a low‑tax jurisdiction like Singapore or the Caymans.

Are there residency benefits when buying in Monaco?

- Yes—purchasing property valued above €1 million can facilitate long‑term residency permits.

Conclusion & Next Steps

By now, you’ve seen exactly how overseas property investment combines international real estate funding and offshore wealth management to unlock luxury real estate investment opportunities—from structuring cross‑border loans to navigating Monaco’s unique purchase process.

This guide has walked you through every stage of how to buy property in Monaco, highlighted risk‑management best practices, and shared real‑world case studies that prove these strategies work.

Next Steps:

These clear‑cut steps turn ambition into action. Begin by mapping your personal or family office objectives, then build the right funding and legal framework. Once your Monaco acquisition is underway, continue refining your approach with regular portfolio reviews and market updates.

By following this roadmap, you’re not just investing in a property—you’re crafting a globally diversified strategy that capitalizes on premier addresses, maximizes yield, and safeguards wealth offshore.

Ready to make your move? Bookmark this guide, download our Monaco purchase checklist, and subscribe for quarterly insights on the latest high‑yield markets.

Curious about how overseas property investment and international real estate funding can shape your luxury real estate investment or guide how to buy property in Monaco?

Tell us your thoughts below! #OverseasPropertyInvestment #InternationalRealEstateFunding #OffshoreWealthManagement #LuxuryRealEstateInvestment #HowToBuyPropertyInMonaco

The Hospitality Compass ~ how overseas property investment

Post a Comment for "How Overseas Property Investment Funds Luxury Real Estate Abroad?"

Post a Comment